On its Zillow lender page, TD Bank has a 4.91 rating based on 586 customer reviews. What size TD Mortgage can I afford Enter your details into our handy tool to find out how much you might be able to borrow. The CFPB claimed that TD Bank enrolled customers in its overdraft protection service and charged them overdraft fees without their consent.Ī strong BBB grade indicates a company advertises honestly, responds effectively to customer complaints, and is transparent about business practices. In 2020, the Consumer Financial Protection Bureau ordered TD Bank to pay $97 million in restitution and a $25 million civil money penalty. TD received an A instead of an A+ due to government action against the business. TD Bank has an A rating from the Better Business Bureau. This mortgage also has flexible credit guidelines and allows higher DTIs. It offers a $5,000 lender credit, which can be used toward a down payment or closing costs and doesn't need to be repaid. TD's Home Access mortgage is only available in certain areas to those who meet income limits. It accepts borrowers who meet income limits or live in a low-to-moderate income census tract. TD's Right Step mortgage has flexible credit guidelines, making it easier to qualify for than a traditional mortgage. Physician loans make qualifying for a loan easier for medical professionals, who typically have high debt-to-income ratios (DTI).

#Td bank online mortgage calculator full#

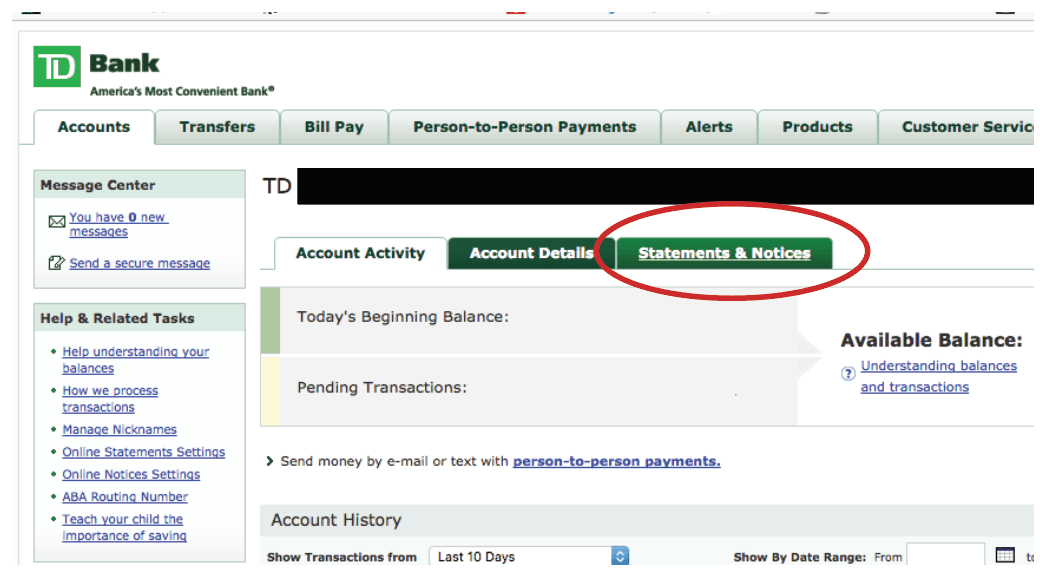

Your FULL account number, including all initial zeros, can be found on your monthly statement and in TD Online Banking.

You will now need to enter your FULL account number including all initial zeroes.

#Td bank online mortgage calculator professional#

Its Medical Professional mortgage is a type of physician loan, and is aimed at doctors, dentists, residents, or fellows. Payments Center has all the functionality you already know, so it's easy to get started: Schedule a new payment1. Enjoy a guaranteed return that is generally higher than a cashable GIC, by locking in your money for a set period of time.

TD Bank offers conforming, FHA, VA, construction, jumbo, Medical Professional, TD Right Step, and TD Home Access mortgages, as well as home equity loans and HELOCs. You can start your application online, or you can talk to a mortgage advisor over the phone. TD Bank lends mortgages in Connecticut, Delaware, Florida, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, and Washington, DC. It also requires no down payment or closing costs.īank of America's Community Affordable Loan Solution and TD Bank's Home Access mortgage are only available in certain areas. This mortgage has no minimum credit score, and instead lets borrowers qualify using non-traditional credit such as their rent or utility payment history. It’s fine.Conforming, FHA, VA, construction, jumbo, Medical Professional, TD Right Step, TD Home Access, home equity loan, HELOCĬonforming, jumbo, FHA, VA, HELOC, Community Affordable Loan Solutionīank of America also offers an affordable mortgage product, called the Community Affordable Loan Solution. PERSON 1: Well, at least the application was easy! That wasn't gla-…it didn't sound like glass, right? That wasn't glass? No. And now all we have to do is sign some documents and just get ready to move! PERSON 1: Everything was explained to us, and we now feel confident and ready to buy our new home. PERSON 1: Amazing! Jonathan, our mortgage is approved! PERSON 1: When we had questions, we were able to connect with a TD Mortgage Specialist over the phone. PERSON 1: Adding a co-borrower was a breeze. Major banks include our top 20 national competitors by MSA, our top five competitors in store share by MSA and any bank with greater or equal store share than TD Bank in the MSA. I know which documents I need and uploading them to the application is easy. Comparison of longest average store hours in the regions (MSAs) in which TD Bank operates compared to major banks. I can complete it in the order that makes the most sense to me. I can fill out the application at my own pace, and TD sends me reminders along the way. PERSON 1: And I kind of feel like staying in my pajamas today. After a quick search online, I saw that TD has a new digital mortgage application, which is great because I'm a super busy person. PERSON 1: I recently found my dream home, and I think I'm ready to get a mortgage.

0 kommentar(er)

0 kommentar(er)